Venture capital investment into U.S. companies slowed markedly in fourth quarter of last year, to the slowest pace in two years.

That drop-off wasn’t enough to knock 2006 from its status as most robust year since 2001, however — and it’s too early too tell whether the slow-down will continue into this year.For all of 2006, investors backed 2,454 companies, slightly ahead of 2005’s level. Total investment was $25.75 billion, an 8 percent increase over the preceding year, according to the quarterly survey by Ernst & Young and Dow Jones VentureOne.

The surprise is the fourth quarter, when VCs backed 561 deals and invest $5.82 billion, drops of 13 percent and 2 percent, respectively, from the fourth quarter of 2005.

This comes at the same time venture capital firms slowed their own fund-raising from their investors to the slowest pace in three years, according to Thomson Financial data released last week.

This comes at the same time venture capital firms slowed their own fund-raising from their investors to the slowest pace in three years, according to Thomson Financial data released last week.

Trends in Silicon Valley reflected the slowdown seen in the rest of the nation. VCs invested $1.94 billion in local companies, down from $2.12 billion the same quarter of 2005.

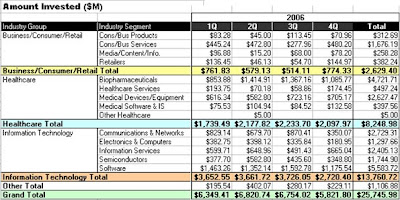

See diagram below, which suggests the interactive Web companies (dubbed Web 2.0) were among the few sectors to grab more money in the fourth quarter compared to the third quarter. The classifications aren’t perfect, but see “consumer/business services” and “media/content”, for example.

See diagram below, which suggests the interactive Web companies (dubbed Web 2.0) were among the few sectors to grab more money in the fourth quarter compared to the third quarter. The classifications aren’t perfect, but see “consumer/business services” and “media/content”, for example.

But if you stand back, and look at 2006 year as a whole, investments increased across each of the three main industries tracked

(a) healthcare,

(b) IT and

(c) consumer and business products and services, so this a broad recovery.

Within IT, though investments fell in the sub-category of chips.

The clear winner was alternative energy, where investments boomed 190 percent, compared to the year before.

Highlights:

–Healthcare in 2006 — 628 companies were invested in; 5% increase from 2005

–11.3% drop in communication & networking in 2006

–14% increase in electronics & computing

–27.5% increase in information systems

–6.6% drop in semiconductors

–1.8% increase in software

–Alternative Energy in 2006 - $537.6 million in 41 companies; 190% increase from 2005

The biggest deals are listed in a table at bottom.

Meanwhile, data suggests that less money can sometimes be better, according to the number-crunchers at Bridgescale, a new Silicon Valley venture firm (see Venture Beat story here). The firm used VentureOne statistics and other sources to track IPOs and mergers and acquistions. Companies funded by angels initially take in three rounds of venture capital, on average, instead of four, they found. This suggests these angel-backed companies are more efficient. Indeed, these angel-backed companies ended up taking $15 million less money from investors than other companies did before their exits — or $50 million, versus $65 million.

Finally, these companies accounted for $700 million in total investments, but led to $10 billion in exit value, a 15-fold return, Bridgescale found. That compares to $2 billion invested, and a $13 billion exit value for other companies, or a 6-fold return.

Source Feed: VentureBeat

No comments:

Post a Comment